Affordable Cheep Car Insurance Options for October 2024

In October 2024, USAA, Nationwide, Travelers, Erie, Geico, and Progressive stand out as the most affordable cheep car insurance providers across the United States, based on our comprehensive analysis.

As we move into the fall season, the costs of car insurance are on the rise. To assist you in finding the best options for your situation, we’ve examined rates tailored to different age groups and driving profiles.

Best Affordable Cheep Car Insurance Rates This Month

Here are the most economical car insurance options for October 2024, categorized by driver profiles:

Affordable Cheep Car Insurance Rates by Driver Profile

Finding cheap car insurance can vary based on your driving history and profile. Below is a breakdown of average monthly costs for different types of drivers in October 2024. This information can help you select the best option for your situation.

How We Selected the Most Affordable Car Insurance

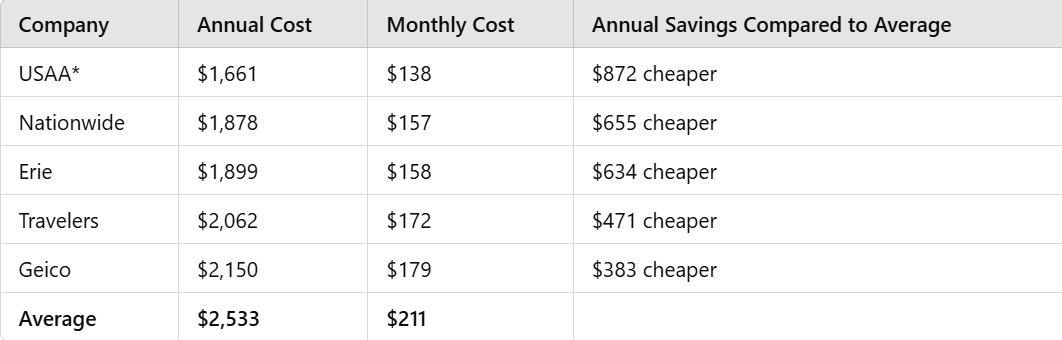

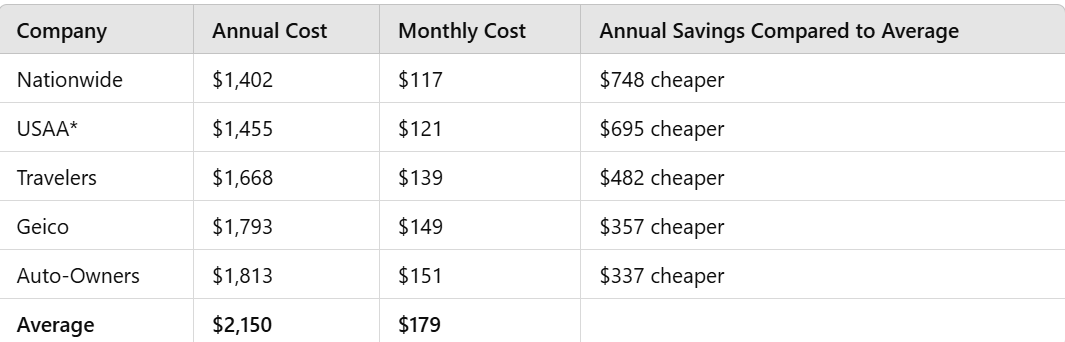

Affordable Car Insurance for Individuals with Poor Credit

For drivers with bad credit, Nationwide and Geico offer relatively low rates for cheap car insurance. Additionally, USAA is a solid choice for military personnel and veterans.

Having poor credit can result in higher auto insurance premiums than those associated with a DUI or an at-fault accident. On average, auto insurance costs increase by 94% for drivers with poor credit compared to those with good credit.

Average Costs for Car Insurance with Bad Credit

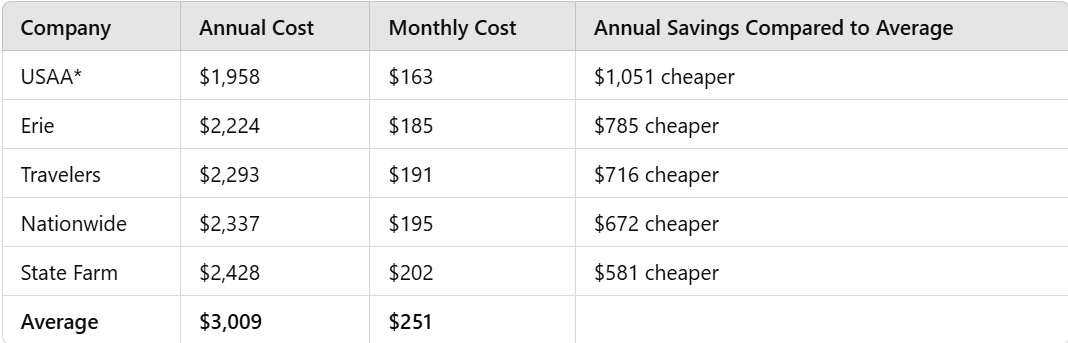

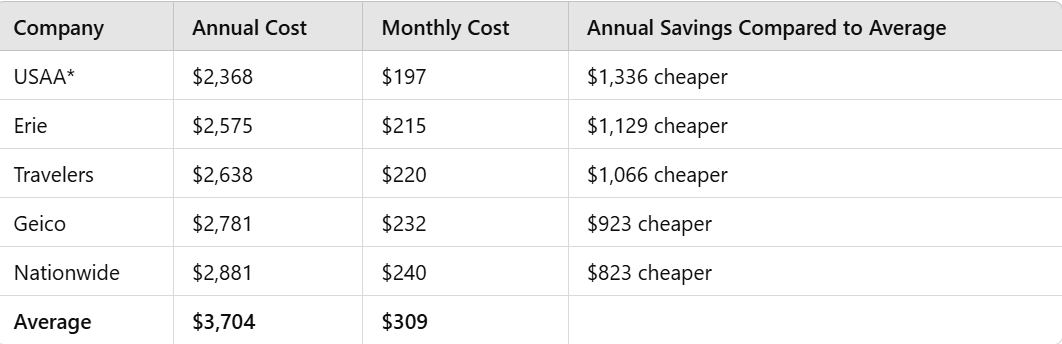

Affordable Car Insurance for Senior Drivers

According to our analysis, Nationwide offers the most competitive rates for senior drivers aged 65 to 80. The ideal cheap car insurance for seniors can vary depending on factors such as your location and personal details, including your driving history.

On average, senior drivers experience a 6% increase in insurance rates from ages 60 to 70. By age 80, premiums may rise by 23% compared to rates at age 70 and 31% compared to those at age 60.

Average Costs for Car Insurance for Seniors

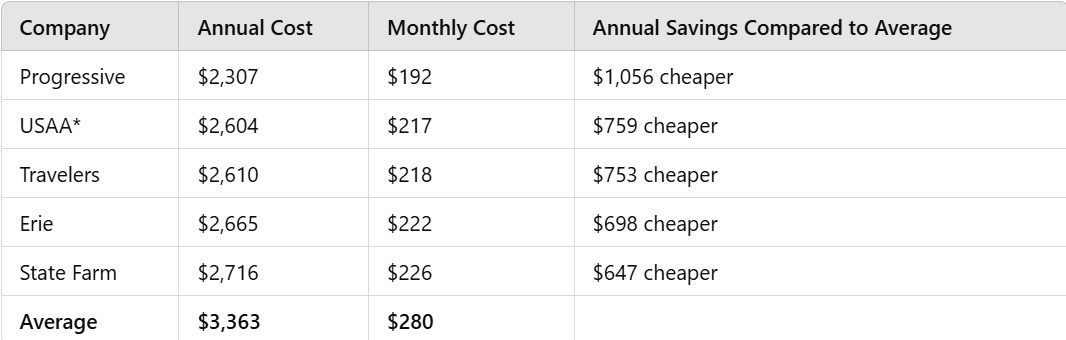

Affordable Car Insurance for Young Drivers

For young drivers seeking their own policies, Erie, Travelers, Geico, and Nationwide are the most affordable options for cheap car insurance. Additionally, USAA is a highly regarded choice for those who qualify, particularly military members and veterans.

Typically, it is more economical for young drivers to stay on their parents’ insurance policy if they live at home, whether they are 18 or 25 years old.

Average Costs for Young Drivers

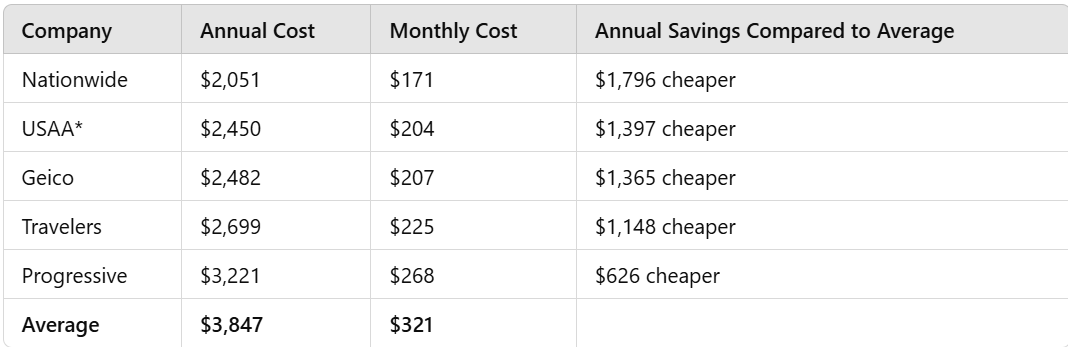

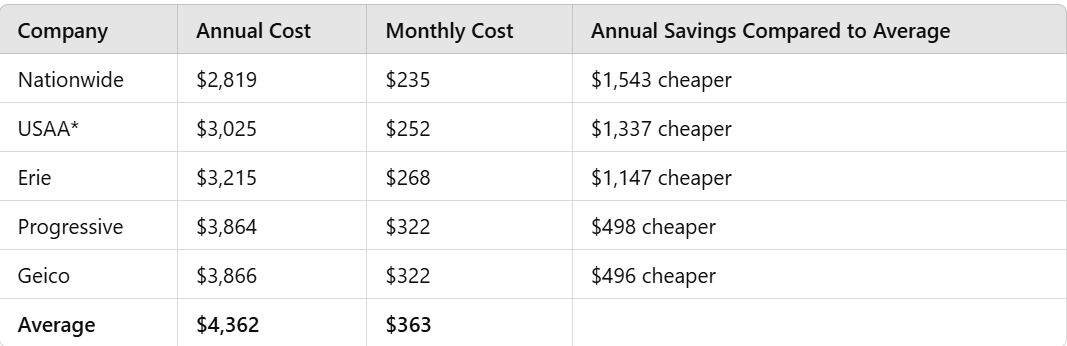

Car Insurance After Adding a Teen Driver

When adding a teen driver to a parent’s policy, Nationwide offers the lowest rates, with Erie, Progressive, and Geico also providing competitive options. USAA typically has reasonable rates for adding a teen driver if you qualify.

Finding affordable car insurance for teenagers can be challenging, as they are considered high-risk by insurers. On average, adding a teen driver to a parent’s policy costs about $4,362 per year.

Typically, adding a teenage driver significantly increases the parent’s auto insurance premium, often doubling it. However, it is generally more cost-effective to include a teen on a parent’s policy rather than having them obtain their own insurance.

Average Costs for Adding a Teen Driver

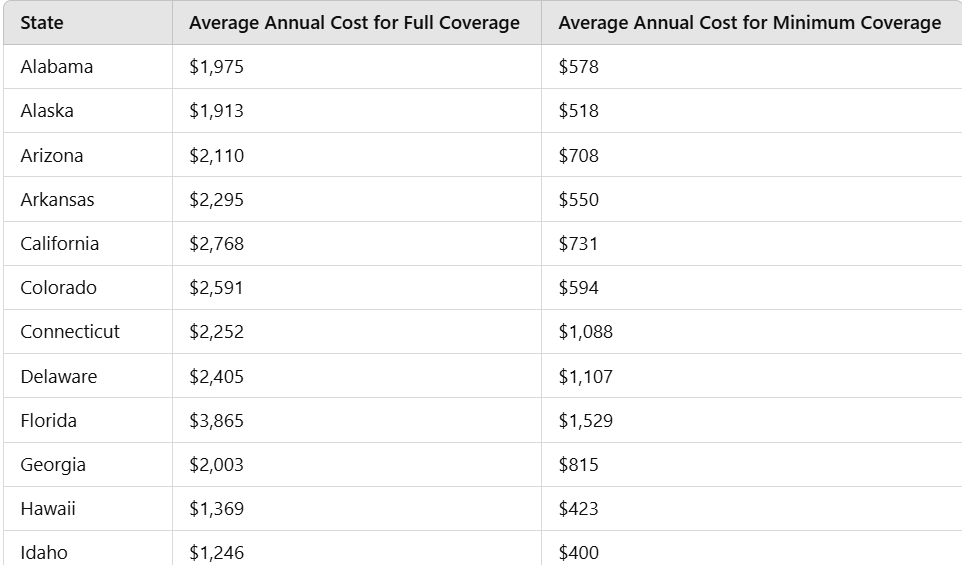

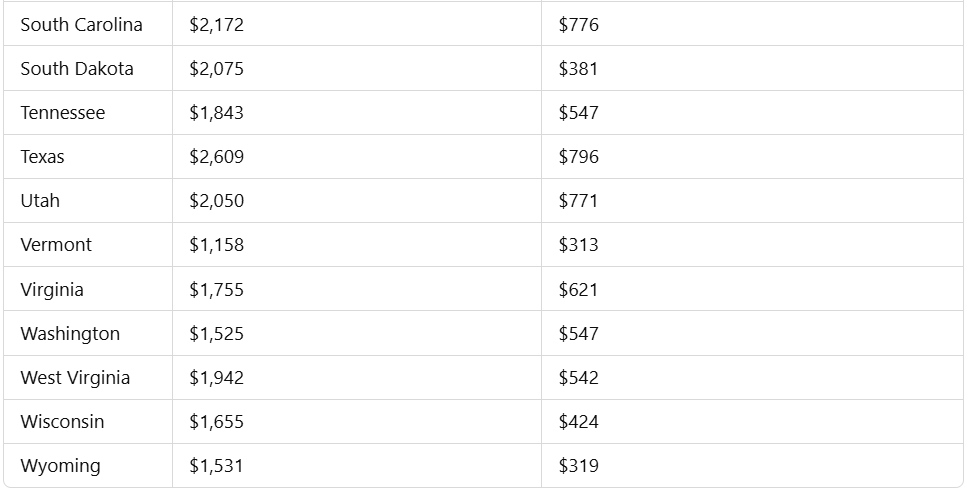

States with the Most Affordable Car Insurance

Vermont ranks as the state with the lowest auto insurance rates for safe drivers. Following Vermont, the states with the next cheapest car insurance are Idaho, Maine, Hawaii, and New Hampshire. The variation in car insurance rates across different states can be attributed to diverse risk factors and claims history.

Average Annual Car Insurance Costs by State

Here is a summary of the average annual costs for full coverage and minimum coverage car insurance across various states:

Understanding the Risks of Choosing Cheap Car Insurance

While purchasing a cheap car insurance policy with minimal coverage might seem like a cost-effective choice, it can lead to significant financial risks in the long run. Here are some of the potential drawbacks of opting for such a policy:

Insufficient Liability Coverage

When you buy a policy with only the minimum state-required liability limits, you may not have enough coverage to handle the full extent of damages you cause in an accident. If the costs exceed your liability limits, you could be held personally responsible for the remaining amount, potentially leading to serious financial hardship.

Coverage Limitations

The most affordable auto insurance policies often provide only state minimum coverage, leaving you without critical protections such as collision and comprehensive coverage. These types of coverage are essential as they pay for damages to your vehicle from accidents, theft, vandalism, flooding, hail, and other specific issues. Without them, you risk incurring significant out-of-pocket expenses if your car is damaged.

Methodology for Evaluating Cheap Car Insurance

To determine the cheap car insurance companies, we assessed various insurers based on several key factors, including their average rates for different driver profiles, consumer complaints, and collision repair ratings from industry professionals.

Average Insurance Rates (80% of Total Score)

We utilized data from Quadrant Information Services to analyze average rates from each company for a diverse range of drivers. The profiles included:

- Good drivers

- Drivers with an accident on record

- Drivers with a speeding ticket

- Drivers with a DUI

- Drivers with poor credit

- Uninsured drivers

- Young and senior drivers

- Adding a teen driver to a policy

Rates are generally calculated for a 40-year-old female driver insuring a new Toyota RAV4 with the following coverage levels:

- Liability Coverage: $100,000 for injuries to one person, $300,000 for total injuries per accident, and $100,000 for property damage (100/300/100).

- Uninsured Motorist Coverage: $100,000/$300,000.

- Collision and Comprehensive Insurance: $500 deductible.

State minimum coverage rates reflect the lowest level of auto insurance required in each state.

Consumer Complaints (10% of Total Score)

We analyzed auto insurance complaint data from the National Association of Insurance Commissioners. Each state’s department of insurance tracks and manages complaints against insurers. The majority of complaints relate to claims, including dissatisfaction with settlements, delays, and denials.

The industry average for complaints is set at 1.00. Companies with a ratio below 1.00 indicate a lower level of complaints.

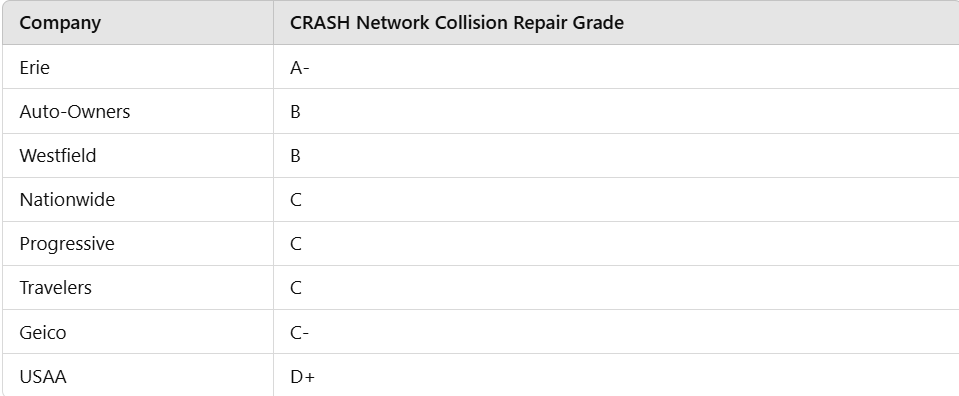

Collision Repair Ratings (10% of Total Score)

We incorporated grades from collision repair professionals, as reported by CRASH Network, which focuses on the collision repair and auto insurance markets. The CRASH Network’s Insurer Report Card features ratings from over 1,100 collision repair professionals, assessing auto insurers based on the quality of their collision claims service.

Collision Repair Grades by Company

This comprehensive methodology ensures a thorough evaluation of cheap car insurance providers, helping consumers make informed choices based on rates, service quality, and customer satisfaction.

This comprehensive methodology ensures a thorough evaluation of cheap car insurance providers, helping consumers make informed choices based on rates, service quality, and customer satisfaction.