Organizational behavior (OB) refers to the study of how individuals and groups act within organizations and how this behavior affects the overall functioning and success of the organization. In an insurance agency, organizational behavior is crucial to understanding how various factors such as leadership, communication, motivation, teamwork, and company culture influence performance and customer satisfaction. Since insurance is a service-driven industry, the dynamics between employees, managers, and clients significantly impact the agency’s operations and long-term success.

This article delves into the critical aspects of organizational behavior in an insurance agency, including leadership styles, communication strategies, motivation techniques, team collaboration, company culture, and how each of these elements contributes to the agency’s performance and success.

1. Leadership in Insurance Agencies

Leadership plays a pivotal role in shaping the organizational behavior of an insurance agency. Leaders in insurance agencies are responsible for setting the tone for the entire organization, establishing strategic goals, motivating employees, and ensuring that the agency provides quality service to its clients. The leadership style adopted by an agency can directly affect employee engagement, job satisfaction, and overall productivity.

1.1 Transformational vs. Transactional Leadership

In insurance agencies, two predominant leadership styles can be observed: transformational and transactional leadership.

- Transformational Leadership: Transformational leaders inspire and motivate employees by providing a vision that aligns with both organizational and personal goals. In insurance agencies, transformational leaders may focus on enhancing customer service, promoting innovation in policy offerings, and encouraging employees to improve their skills. These leaders create an environment that fosters personal growth and innovation, which can be crucial in an industry that is continually evolving in response to new risks, regulatory changes, and client demands.

- Transactional Leadership: On the other hand, transactional leaders focus on the exchange between management and employees, where rewards and punishments are used to maintain control and ensure that tasks are completed. In an insurance agency, this might translate to rewarding sales agents for reaching quotas or penalizing employees for not meeting service expectations. While transactional leadership can create clear expectations and accountability, it may not always foster long-term engagement and innovation.

The most successful insurance agencies often blend both leadership styles, encouraging innovation and employee development while maintaining accountability and performance metrics.

2. Communication within an Insurance Agency

Effective communication is the cornerstone of organizational behavior in an insurance agency. Given the complex nature of the insurance industry, where policies, regulations, and client needs are constantly evolving, clear and efficient communication is essential to ensuring smooth operations and high levels of customer satisfaction.

2.1 Internal Communication

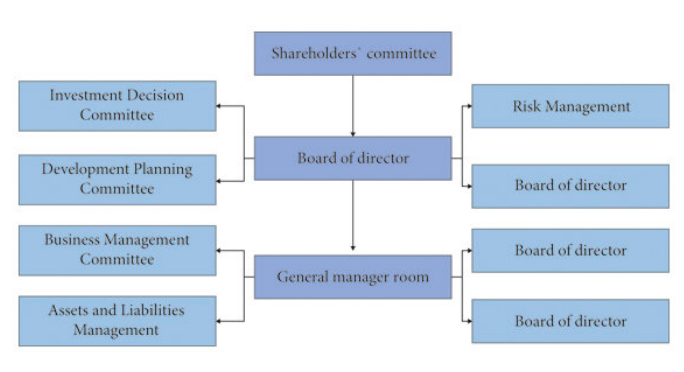

Internal communication refers to how information flows between different levels of the agency, from management to employees and between departments. Insurance agencies must have robust communication channels to ensure that critical information such as new policy updates, regulatory changes, or client issues is disseminated quickly and accurately.

- Vertical Communication: This is the communication that occurs between different hierarchical levels in the agency. For example, managers must effectively communicate company goals, policy changes, or performance feedback to their employees. Open and transparent vertical communication can increase employee trust in leadership and reduce misunderstandings.

- Horizontal Communication: Horizontal communication occurs between employees and departments at the same level within the agency. In an insurance agency, cross-departmental communication between the underwriting, claims, and sales departments is essential for providing comprehensive client service. For example, sales agents need to work closely with underwriters to ensure that the policies they sell align with underwriting criteria, and claims adjusters need to communicate with both departments to ensure seamless customer experiences during the claims process.

2.2 External Communication

External communication refers to how the insurance agency communicates with clients, partners, and other stakeholders. Customer-facing employees, such as sales agents and customer service representatives, must have excellent communication skills to explain complex insurance policies, handle customer complaints, and provide timely and accurate information to clients. Clear external communication builds trust and loyalty among clients, which is critical for retaining customers in a competitive market.

3. Motivation and Employee Engagement

Motivation is a key aspect of organizational behavior, and it plays a significant role in determining the productivity and satisfaction of employees within an insurance agency. The agency must implement strategies to keep employees motivated, especially in high-pressure environments where meeting sales targets, addressing client concerns, and processing claims are everyday tasks.

3.1 Monetary vs. Non-Monetary Motivation

Insurance agencies often use a combination of monetary and non-monetary incentives to motivate their employees.

- Monetary Motivation: In the insurance industry, monetary incentives such as bonuses, commissions, and performance-based pay are widely used, especially for sales agents. These financial rewards can be effective in driving short-term performance, particularly in achieving sales targets. However, over-reliance on monetary incentives can sometimes lead to a narrow focus on sales numbers rather than customer satisfaction and service quality.

- Non-Monetary Motivation: Non-monetary motivation includes recognition programs, professional development opportunities, and creating a positive work environment. Recognizing employees for their hard work, offering career advancement opportunities, and fostering a sense of belonging can lead to higher levels of employee engagement and long-term loyalty to the agency. Non-monetary motivation is essential in promoting intrinsic motivation, where employees feel personally invested in the agency’s success.

3.2 Employee Development and Training

Continuous employee development is vital in the insurance industry due to the ever-changing nature of regulations, products, and market demands. Providing ongoing training and development opportunities not only keeps employees motivated but also enhances their ability to perform their jobs effectively. Insurance agencies that invest in the professional development of their employees often see better customer service, improved problem-solving, and increased innovation within the organization.

4. Team Collaboration and Coordination

Teamwork is essential for the smooth functioning of an insurance agency. Departments such as sales, underwriting, claims, and customer service need to work together to ensure that clients receive comprehensive service and that policies are sold, processed, and maintained efficiently. Effective team collaboration helps to minimize errors, improve customer satisfaction, and increase overall productivity.

4.1 Cross-Functional Teams

Many insurance agencies utilize cross-functional teams to handle specific tasks or projects that require input from multiple departments. For example, when launching a new insurance product, a team consisting of members from the marketing, sales, underwriting, and customer service departments may collaborate to ensure that the product is effectively marketed, sold, and supported. Cross-functional teams allow for diverse perspectives and expertise to contribute to the success of the project.

4.2 Conflict Management

Given the diverse nature of teams within an insurance agency, conflicts may arise between employees from different departments with competing priorities. For instance, sales agents may push for policies to be approved quickly to close deals, while underwriters may require more time to thoroughly assess risk. Effective conflict management strategies are essential to ensuring that conflicts do not negatively impact the agency’s performance or customer service. Agencies that prioritize open communication, mutual respect, and problem-solving can resolve conflicts more efficiently, leading to a more harmonious and productive work environment.

5. Organizational Culture in Insurance Agencies

The organizational culture of an insurance agency significantly influences employee behavior, job satisfaction, and overall agency performance. Organizational culture refers to the shared values, beliefs, and norms that guide how employees interact with one another and with clients.

5.1 Customer-Centric Culture

A customer-centric culture is essential in the insurance industry, where client relationships are critical to success. Insurance agencies that emphasize the importance of customer service, trust, and integrity are more likely to retain clients and attract new business. In a customer-centric culture, employees are trained to prioritize client needs, provide transparent communication, and go above and beyond to ensure client satisfaction.

5.2 Performance-Driven Culture

In many insurance agencies, a performance-driven culture is prevalent, especially in the sales department. Employees are often rewarded based on their ability to meet or exceed targets, and high-performing individuals are recognized for their contributions. While a performance-driven culture can motivate employees to achieve results, it is essential to balance it with a focus on ethical behavior and long-term client relationships to avoid aggressive sales tactics that may damage the agency’s reputation.

5.3 Innovation and Adaptability

In an industry that faces constant regulatory changes and evolving market demands, fostering a culture of innovation and adaptability is critical. Insurance agencies that encourage employees to think creatively and embrace change are better positioned to remain competitive. This includes staying open to new technologies, such as data analytics and automation, which can improve efficiency and enhance the customer experience.

6. The Role of Technology in Shaping Organizational Behavior

Technology is transforming the organizational behavior of insurance agencies by automating processes, improving communication, and enhancing data analysis. Agencies that effectively integrate technology into their operations can streamline workflows, reduce human error, and improve decision-making.

6.1 Automation and Efficiency

Automation is particularly beneficial in areas such as claims processing, underwriting, and customer service. For example, automated claims systems can significantly reduce the time it takes to process and approve claims, leading to faster payouts for clients and improved customer satisfaction. Automation also frees up employees to focus on higher-value tasks, such as building relationships with clients and developing new products.

6.2 Data-Driven Decision Making

The use of big data and analytics is increasingly shaping organizational behavior in insurance agencies. By analyzing data on customer behavior, risk factors, and market trends, agencies can make more informed decisions about pricing, product development, and marketing strategies. Data-driven decision-making enables agencies to better understand their clients’ needs and tailor their offerings accordingly.

Conclusion

Organizational behavior in an insurance agency is a complex interplay of leadership, communication, motivation, teamwork, and company culture. The success of an insurance agency largely depends on its ability to manage these elements effectively to create a positive work environment, foster employee engagement, and deliver exceptional customer service. As the insurance industry continues to evolve in response to technological advancements and changing market demands, agencies that prioritize strong organizational behavior will be better positioned to thrive in an increasingly competitive landscape.